You can easily add money to your Cash App account by sending it from your bank account, using a debit card, or having a friend send the money. If all of those options are not feasible, there’s a fourth option, which involves adding money to your account from stores like Dollar General.

While this method may not be one of the most popular ones out there, it works. Cash App recently added a paper money option that lets users add paper money to their Cash App account by walking into stores like Walmart, Dollar General, or CVS, but it’s clear that not all users have that option at the moment.

In this article, you’ll learn why you still don’t have the paper money option on your Cash App account. Also, I’ll show you how to get the paper money option on Cash App. Finally, you’ll get answers to some other pressing questions, like how much it costs to add paper money to Cash App, for example.

How Much Does It Cost to Add Paper Money to Cash App?

It costs any amount that the service provider is willing to charge for the service. Cash App doesn’t regulate how much individual stores charge for adding paper money to your account, so you’ll have to abide by their terms if at all you intend to use their services.

How to Get the Paper Money Option on Cash App

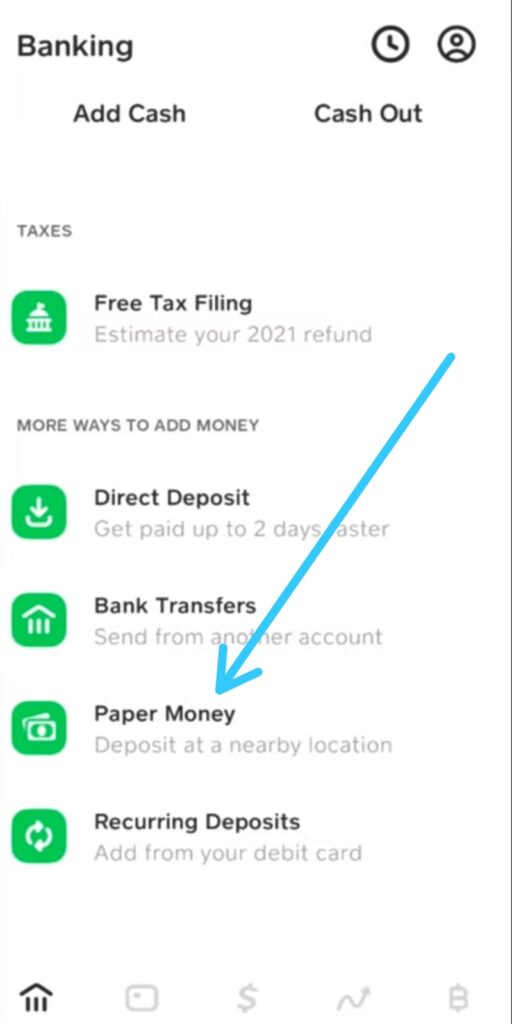

You can get the Paper Money option on Cash App by navigating to the Banking tab on the default Cash App homepage. From there, select the Paper Money option and there you go. If you can’t find it, there must be something seriously wrong with your account.

One of the biggest reasons the Paper Money option could be missing from your app is that you’re using an outdated app. Being a recently introduced feature, you must be on one of the recent iterations of the app to be able to access it. Also, you may want to consider verifying your account, as that could also help.

How Long Does Paper Money Take On Cash App?

Cash App payments are processed immediately. However, depending on the bank, it may take a few minutes for the funds to be available in your account.

Paper Money Deposit Limits

Cash App Paper Money deposit allows you to deposit up to $1,000 per rolling of 7 days, and $4,000 per rolling 30 days. The minimum deposit is $5 and cannot exceed $500 per deposit.

Cash App Paper Money Deposit Locations

According to Cash App, these are the supported merchants of paper money deposits. Use the map in the Paper Money section of your Banking tab to find a deposit location near you.

- Walmart (Customer Service Desk/ Money Centers)

- Walgreens

- Duane Reade

- 7-Eleven

- Family Dollar

- GoMart

- Sheetz

- Kum & Go

- KwikTrip

- Speedway

- H-E-B

- GoMart

- Rite Aid

- Thorntons

- TravelCenters of America

- Dollar General

- Pilot Travel Centers

How Can I Add Money to My Cash App without Debit Card?

It’s no secret that the easiest way to add money to your Cash App account is by linking it to a debit card or bank account and using the said account or card to top it up. However, assuming you can’t access a debit card, how can you add money to your Cash App account?

You still have the bank account option, but that seems like a cheat code; if someone doesn’t have a debit card, it’s pretty safe to assume it’s because they don’t have a functioning bank account. So, there should be ways to fund a Cash App account without either a bank account or a debit card.

The easiest one that comes to mind, and one that works for all kinds of accounts is paying a friend or someone you know to top you up. If they have enough funds in their account and are willing to take cash for some of it, you can give them the cash in exchange for some Cash App credit.

Another option is using the paper money deposit option that’s available with Cash App by default. Simply head over to one of the supported locations, and when you get there, navigate to the Banking tab from your Cash App homepage and select the Paper Money option to get a barcode.

Then, show the barcode to the cashier, let them know you’re trying to deposit money and give them the value of the deposit you’re trying to make, plus the service fee they’re demanding. You should get the value of the money in your Cash App balance in a couple of minutes.

How Can I Put Money on My Cash App without a Bank Account?

In the preceding section, I explained how you can put money in your Cash App account without a debit card. However, if you read it carefully, you’ll notice that I also factored in people without a valid bank account, making it a useful guide if you lack either a bank account, a debit card, or both.

The only thing I’ll add to the section is that it’s possible to link a debit card to your Cash App account and fund your account using money from the card. Since the section already assumes you don’t have a card, there was no way I was going to add that.

Where Can I Pull Out Money From Cash App?

“Pulling out” money seems like a very odd way to describe withdrawing money from your Cash App account, but it does aptly represent it, at least, in this context. If you have a sizeable sum of money in your Cash App account, where can you possibly withdraw it?

The recommended way is to use your Cash Card at any ATM that accepts Visa cards. That way, you get cash instantly without needing to wait for days or weeks, while incurring minimal fees. For someone without a physical Cash Card, however, that option is completely unfeasible.

Another option you may want to try is using the Cash Out option to withdraw the money to a linked bank account. Then, using a debit card associated with the account, you can easily withdraw the money. That sounds like it has many extra steps, but it’s the only other official way if you don’t have a Cash Card.

If you don’t have a linked bank account or debit card either, the last resort is trading some Cash App funds for cash. This method is the riskiest, and you shouldn’t even consider it if you don’t have a friend that’s willing to buy Cash App funds for cash, but if you have one, why not?

Can You Add Paper Money To Cash App At Walmart?

Yes!

Adding paper money to Cash App at Walmart is simple. Just head to the “My Wal-Mart” section of the app and select “Add Money.” You’ll be prompted to scan the barcode on your bank note and then select “Add Money.” You’ll then be asked to enter your bank account number and routing number. Finally, you’ll be asked to confirm your addition.

Why Doesn’t My Cash App Have Paper Money

If the Paper Money option is not available on your Cash App account, it could be because your account is unverified. When your Cash App account is unverified, you may not be able to access several features, including the Paper Money option. Additionally, if you have just opened your Cash App account, it might take some time before the Paper Money option becomes visible.

Last, running an outdated version of the Cash App may also be the cause of the problem since it takes an update for the app to offer you the feature.

Conclusion

Cash App’s Paper Money option makes it possible to add money to the app from stores like CVS, Dollar General, and Walmart. If you don’t know how to find the option, don’t fret; this article has got you covered.

FAQS

Is there a fee for using the Paper Money option on Cash App?

No, the Paper Money option on Cash App is a free feature.

John Gurche was born in Los Angeles, California, and raised in Utah, England, New York, and Los Angeles again. He attended the University of California, Santa Barbara, earning his BA in 1969, and his Ph.D. in 1975. He is the author of 10 books, including: A History of Western Philosophy (with Stephen Toulmin), The Moral Landscape: How Science Can Determine Human Values, and The Liberal Imagination.